Family Business Succession and the Constitution

junio 20, 2025Insights

Challenges for the family business

A family business has some unique characteristics and challenges.

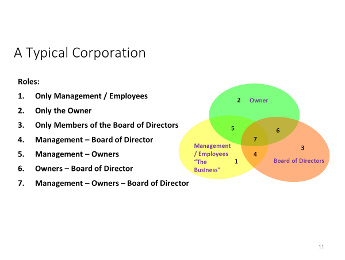

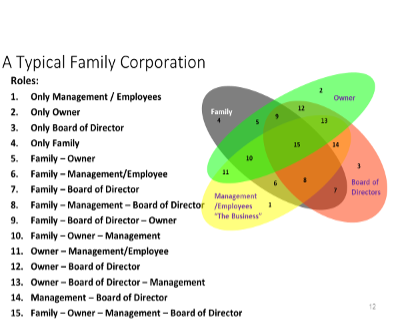

While a family enterprise may be a business like any other, the ownership structure adds complexities. Being family-owned and managed can lead to additional conflicting interactions, beyond what one may find in a traditional corporation. These types of corporations usually entail seven different possible positions in which an individual may participate: Shareholder, Director, Employee, and the other two-way and three-way interactions. When one superimposes these with family affiliations, the total number of possibilities grows exponentially to 15, adding several three-way interactions and even one four-way interaction where the same person can be Family, Shareholder, Director, and Employee simultaneously.

There are additional challenges these businesses face when taking the generational journey from an informal approach to business transactions towards a more formal enterprise operating structure and governance.

During the last decade, my work with family-owned companies has shed light on relationship and operating challenges that, if not dealt with, dramatically impact the future and the value of the company.

The following are a few of these challenges:

- Family companies deal with at least three cultures: that particular family culture, the business field’s market culture, and the outside world culture. When succession takes place, family cultural aspects may be affected. This can potentially lead to a new three culture balance that strongly impacts business performance.

- The new generation faces the challenges of interpreting the family business’s unwritten rules, as reflected in the work environment and their way of functioning. Similarly, they are faced with the difficulties of being accepted by the suppliers, banks, clients, and employees.

- In 2018 Insights magazine published an incisive article. It was a creative approach about defining transition: from driving the next generation to work outside of the family enterprise, and that experience PAVING (paved) the road for them to later join the family operation.

- One must find the right approach with the members of the next generation IN ORDER to motivate them to work within the family group dynamics; to allow them to find their well-balanced individual and collective voice; to create an adjustment, adaptation, and development process; and finally to allow them to thrive independently.

- Take advantage of the experience of previous generations. If needed use external advisors.

- Succession plans should start as soon as the operation becomes profitable. 43% of family-owned businesses do not have a succession plan in place. Historically, 72% of family businesses transfer ownership to the next generation. In the event of a sudden unplanned occurrence, the probability of failure grows exponentially by not having a planned set of steps for transition.

- Every transition process must account for: differentiating ownership from employment; owners’ authority from leadership and management; understanding the running of the company as well as how business is handled; finally a structured model to taking control. The designated successor should BE CONCERNED ABOUT (show interest in) the future of the corporation, intellectual curiosity, strategic thinking, financial comprehension, have relevant education, and protect the family heritage.

- If the outgoing generation does not wish to give up control, do not initiate the succession plan. Instead, there are other alternatives in which the next generation can achieve control over the enterprise. They could either purchase the business outright; leverage the buy-out; installments sales; self-canceling installment notes; or even a charitable bailout.

George Kastner

12-2020